Drive to diversify from oil brings investments in tourism, technology and other sectors

Colombia is attracting an unprecedented surge in greenfield foreign investment, especially in the tourism, real estate, technology and pharmaceutical sectors, in a further sign that South America’s second most populous nation is diversifying away from its dependency on oil, helped by a regulatory agenda aimed at drawing in investors across the economy.

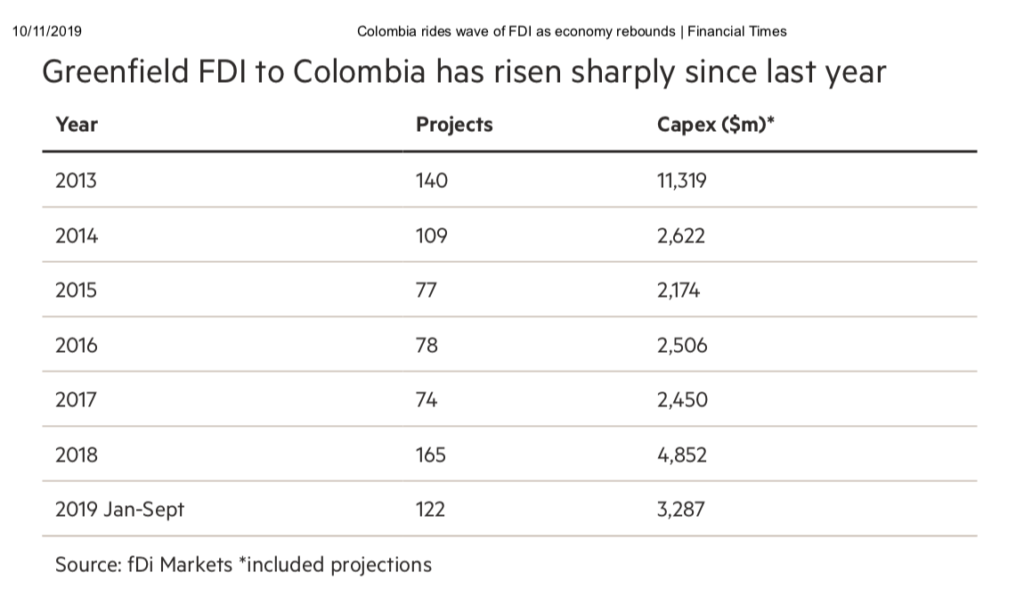

Foreign companies announced a record 165 investment projects valued at $4.8bn in Colombia last year, more than doubling the figures for 2017, according to fDi Markets, a Financial Times data service that monitors greenfield (and therefore job-creating) cross-border investment. Investment from the US and Canada was particularly strong.

“Colombia’s FDI inflows have seen substantial diversification in recent years as the market’s

relatively large size, favourable dynamics in key sectors and largely supportive government policies have increased the attractiveness of non-extractive sectors,” said Lee Sutton, country risk analyst at Fitch Solutions.

He said diversification had been a priority for the government, illustrated by President Iván Duque’s recent visit to China.

At an investment summit in Bogotá this month, the government announced new foreign ventures worth more than $1bn. On the eve of the summit, a Chinese consortium clinched a $4.3bn contract to build the first line of Bogotá’s long-overdue metro system. Colombia’s economy is set to grow by 3.4 per cent this year, according to the IMF, easily the fastest pace among Latin America’s large economies.

It marks quite a turnround. Foreign direct investment to Colombia fell sharply from 2014 along with the decline in global oil prices. Data from fDi Markets show an average of just 76 projects worth $2.3bn a year in 2015-17, while investment in the oil sector stagnated until last year.

Production of crude oil fell 15 per cent between 2015 and 2017, according to the mines and energy ministry. Analysts at S&P Global expect production to increase only slowly this year.

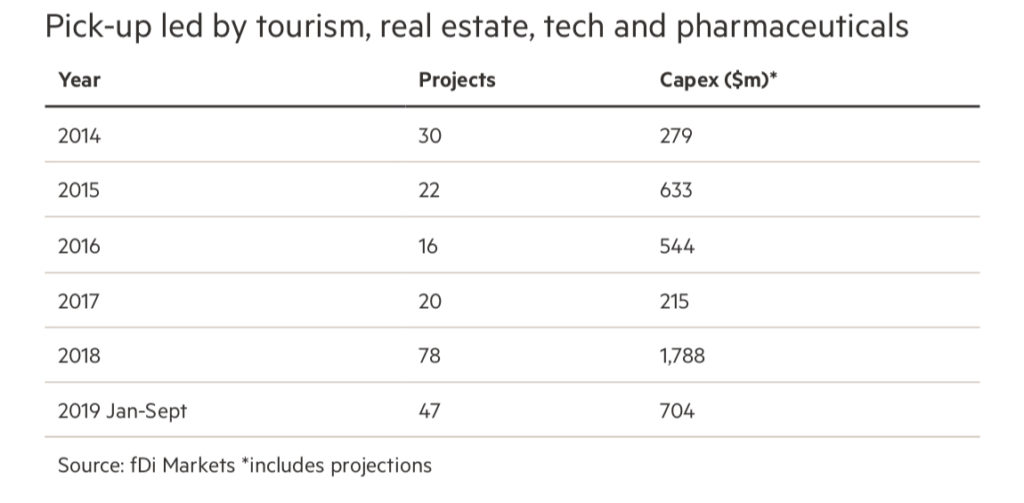

Other sectors, however, are taking up at least part of the slack, especially in tourism, real estate, tech and pharmaceuticals.

Diversification, said Mr Sutton at Fitch, “has offset a weaker investment environment for the oil and gas sector . . . Colombia’s large domestic market, rapidly developing tourism industry and export-oriented agricultural sector all serve as important pillars for growth.” He also noted a significant expansion in financial and other professional services.

Foreign companies announced 122 projects in the nine months to September this year, worth a combined $3.3bn — the country’s best performance in the period since fDi Markets began collecting data in 2003.

Jasmin Chakeri, programme leader for Colombia at the World Bank, said rising greenfield FDI mirrored Colombia’s broader recovery. The Bank expects GDP to rise 3.5 per cent this year, up from 2.7 per cent last year after three years of declining growth since 2014.

Ms Chakeri said investors may have been encouraged by recent tax reforms that reduced the corporate tax rate and the value added tax on imports of capital goods. “That could be interesting for any projects that are capital intensive,” she said.

Changes to tax laws enacted in December 2018 include incentives for the creative industries and tax cuts for infrastructure and other large projects, and for investments in science, technology, innovation and agriculture.

Colombia embarked on a programme of pro-market structural reforms almost a decade ago under the government of Juan Manuel Santos, as it struggled to tackle expanding fiscal deficits and recoup its investment grade rating, lost as a result of an economic crisis in 1999. All three of the large international rating agencies have since restored the country’s investment grade rating.

Last year, Colombia was invited to become the 37th member of the OECD club of the world’s most developed economies, subject to stringent policy reviews and the implementation of further significant reforms. These will include changes to labour law, judicial reform, corporate governance reform for state-owned enterprises, new anti-bribery rules and changes in trade law.

https://www.ft.com/content/e8da97fc-021e-11ea-be59-e49b2a136b8d?desktop=true&segmentId=d8d3e364-5197-20eb-17cf-2437841d178a#myft:notif… 3/5

10/11/2019 Colombia rides wave of FDI as economy rebounds | Financial Times

“Colombia’s governments over the last 25 years have been committed to fiscal discipline, not showing the same swings we’ve seen in other [Latin American] countries, such as debt defaults and other major crises that are driven by fiscal imbalance that you see elsewhere,” said Ms Chakeri.

Colombia ranks 65th among 190 economies in the World Bank’s Ease of Doing Business index, making it the third best business environment in Latin America after Chile and Mexico.

The country has slid down the ranking since 2010, when it was in 37th position. Nevertheless, foreign investors to Colombia since 2014 have consistently cited the regulatory environment as a key driver of investment, along with domestic market growth, the availability of skilled workers and proximity to export markets.

One sector posting strong growth is tourism. Colombia received a record 4.2m visitors last year after seven years of continuous growth, according to ProColombia, the government’s investment promotion agency. World Bank data show that spending by foreign visitors has grown consistently, from $1.3bn in 2003 to $5.1bn in 2017.

Tourism and real estate combined attracted a record number of greenfield foreign investment projects last year, at more than a quarter of the total, according to fDi Markets. Announced investments were worth $1.4bn, almost 30 per cent of the total for the year.

There should still be room for growth, especially given the economic and political instability in nearby rival destinations such as Venezuela and Brazil. Mexico, by comparison, received 41.4m visitors last year, according to the UN’s World Tourism Organization.

The sector attracting the greatest foreign interest, however, is software and IT, with 26 projects worth $170m last year and 18 projects worth $147m to August this year. The biggest sources of such investment were Spain and the US, according to fDi Markets. Spain’s Chatbot Chocolate made Bogotá the site of its first investment in South America last year.

The sector is being supported by government incentives for the creative industries, the so-called orange economy.

Another important sector is medical cannabis production and research. Colombia is the world’s second top destination for greenfield foreign investment in the industry, thanks largely to the government’s proactive policies.

Nicolás Perrone, professor of international law at the Universidad Andrés Bello in Santiago, Chile, says the depreciation of the Colombian peso has been an added draw, making local assets cheaper to foreign investors. He says Colombia’s efforts to join the OECD have helped to drive pro-business reform.

https://www.ft.com/content/e8da97fc-021e-11ea-be59-e49b2a136b8d?desktop=true&segmentId=d8d3e364-5197-20eb-17cf-2437841d178a#myft:notif… 4/5

10/11/2019 Colombia rides wave of FDI as economy rebounds | Financial Times

But many challenges remain, he notes, such as security concerns and the uncertain peace process between the government and the leftwing Farc guerrillas.

Moreover, greater export diversification was needed to improve Colombia’s volatile terms of trade. Oil exports still represented 40 per cent of merchandise exports and 25 per cent of current account receipts in 2018, according to S&P.

“In recent decades, Colombia has created a friendly investment climate,” Prof Perrone said. “But it still faces a high rate of poverty and some of the highest levels of inequality on the continent.”

Additional reporting by Jonathan Wildsmith

Alex Irwin-Hunt is global investment reporter, Sebastian Shehadi is an editor and Jonathan Wildsmith is an analyst at fDi Markets, an FT publication

Copyright The Financial Times Limited 2019. All rights reserved.